Payment of Filing Fee (Check the appropriate box): | | | | | | | | x | | No fee required. | | | | ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | | | | | | (1) | | Title of each class of securities to which transaction applies: | | | | (2) | | Aggregate number of securities to which transaction applies: | | | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | | | | (4) | | Proposed maximum aggregate value of transaction: | | | | (5) | | Total fee paid: | | | | | ¨ | | Fee paid previously with preliminary materials. | | | | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | | | | | | (1) | | Amount Previously Paid: | | | | (2) | | Form, Schedule or Registration Statement No.: | | | | (3) | | Filing Party: | | | | (4) | | Date Filed: |

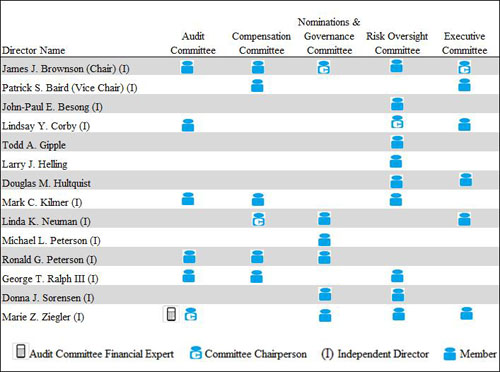

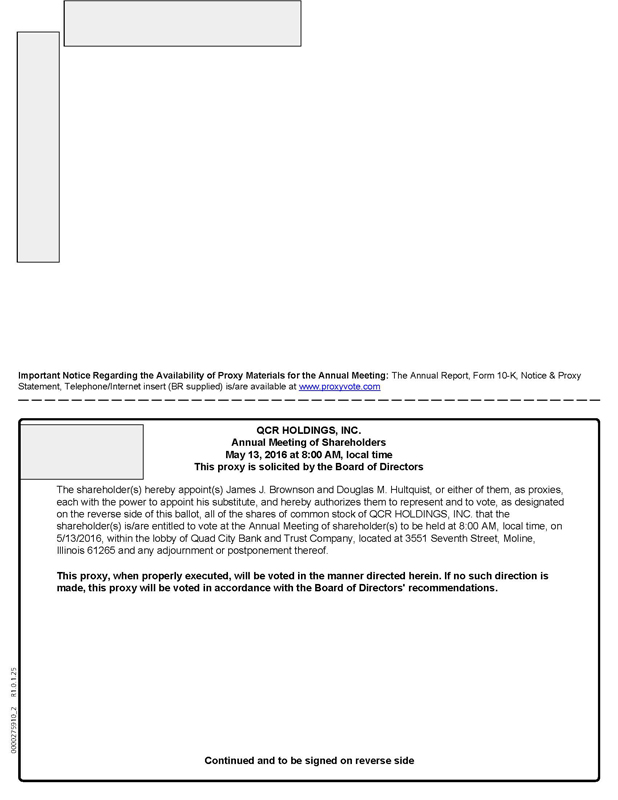

April 1, 2015 2016Dear Fellow Stockholder: On behalf of the board of directors and management of QCR Holdings, Inc., we cordially invite you to attend the annual meeting of stockholders of QCR Holdings, Inc., to be held at 10:8:00 a.m., local time, on Friday, May 15, 2015,13, 2016, within the lobby of Quad City Bank and Trust Company, at the Rogalski Center at St. Ambrose University,corporate offices of QCR Holdings, located at 2100 N. Ripley3551 Seventh Street, Davenport, IA 52803. Moline, Illinois 61265.This year we are again using the Securities and Exchange Commission rule that allows us to furnish our proxy statement, 20142015 Annual Report and proxy card to stockholders over the internet. This means our stockholders will receive only a notice containing instructions on how to access the proxy materials over the internet and vote online. If you receive this notice but would still like to request paper copies of the proxy materials, please follow the instructions on the notice or on the website referred to on the notice. By delivering proxy materials electronically to our stockholders, we can reduce the costs of printing and mailing our proxy materials. Please visit http://www.proxyvote.com for more information about the electronic delivery of proxy materials. There are a number of proposals to be considered at this meeting. Our stockholders will be asked to: (i) elect five persons to serve as Class III directors; (ii) ratify, on an advisory basis, one person to serve as a Class III director; (iii) approve, in a non-binding, advisory vote, the compensation of certain executive officers, which is referred to as a “say-on-pay” proposal; (iii) approve the QCR Holdings, Inc. 2016 Equity Incentive Plan; (iv) to ratify an amendment to the Amended and (iv)Restated Rights Agreement; and (v) ratify the appointment of RSM US LLP (formerly known as McGladrey LLPLLP) as our independent registered public accounting firm for the year ending December 31, 2015. 2016.We recommend that you vote your shares for the director nominees and for all of the other proposals presented at the annual meeting. We encourage you to attend the meeting in person. Regardless of whether you plan to attend the meeting, you should vote by following the instructions provided on the notice as soon as possible. This will assure that your shares are represented at the meeting. At the meeting, we will also report on our operations and the outlook for the year ahead. We look forward to seeing you and visiting with you at the meeting.   | |  |  | | | | | Douglas M. Hultquist | | James J. Brownson | | Douglas M. Hultquist | President and Chief Executive Officer | | Chair of the Board | | President and Chief Executive Officer | | | |

PARENT COMPANY OF: QUAD CITY BANK & TRUST CEDAR RAPIDS BANK & TRUST ROCKFORD BANK & TRUST COMMUNITY BANK & TRUST m2 LEASE FUNDS PARENT COMPANY OF: | QUAD CITY BANK & TRUST | CEDAR RAPIDS BANK & TRUST | ROCKFORD BANK & TRUST | COMMUNITY BANK & TRUST | m2 LEASE FUNDS |

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 15, 2015

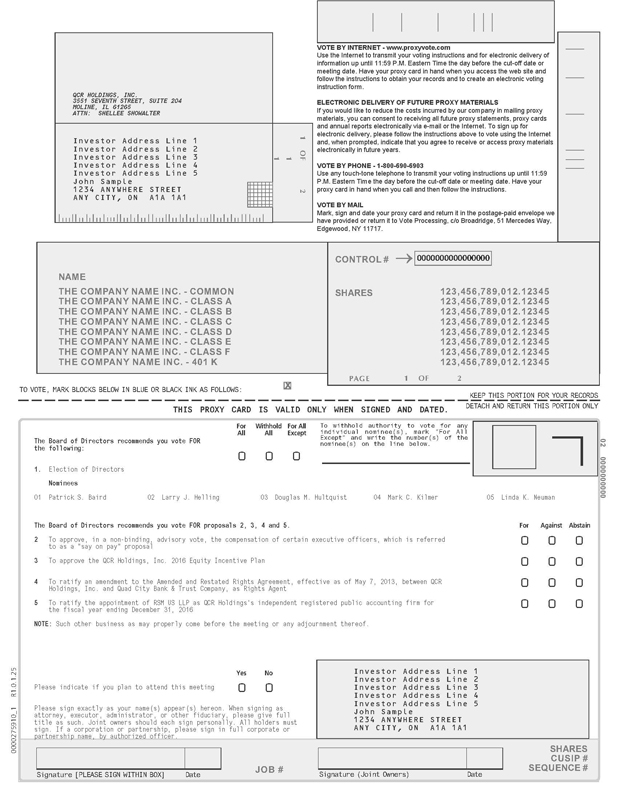

13, 2016To the Stockholders of QCR Holdings, Inc.: The annual meeting of stockholders of QCR Holdings, Inc., a Delaware corporation, will be held within the lobby of Quad City Bank and Trust Company, at the Rogalski Center at St. Ambrose University,our corporate office, located at 2100 N. Ripley3551 Seventh Street, Davenport, IA 52803,Moline, Illinois 61265, on Wednesday,Friday, May 15, 2015,13, 2016, at 10:8:00 a.m., local time, for the following purposes: | 1. | to elect five Class III directors until the regular annual meeting of stockholders in 20182019 and until their successors are elected and have qualified; |

2. | to ratify, on an advisory basis, the appointment of George T. Ralph III to the board of directors to fill a vacancy in Class III, to hold office until the regular annual meeting of stockholders in 2017 and until his successor is elected and has qualified; |

3. 2. | to approve, in a non-binding, advisory vote, the compensation of certain executive officers, which is referred to as a “say-on-pay” proposal; |

| 3. | to approve the QCR Holdings, Inc. 2016 Equity Incentive Plan; |

| 4. | to ratify an amendment to the Amended and Restated Rights Agreement, between QCR Holdings, Inc. and Quad City Bank and Trust Company; |

| 5. | to ratify the appointment of RSM US LLP (formerly known as McGladrey LLPLLP) as QCR Holdings’s independent registered public accounting firm for the fiscal year ending December 31, 2015;2016; and |

5. | 6. | to transact such other business as may properly be brought before the meeting and any adjournments or postponements of the meeting. |

The board of directors has fixed the close of business on March 25, 2015,23, 2016, as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting. In the event there is an insufficient number of votes for a quorum or to approve any of the proposals at the time of the annual meeting, the meeting may be adjourned or postponed in order to permit the further solicitation of proxies.

By order of the Board of Directors

Cathie S. Whiteside

Executive Vice President,

Corporate Strategy, Human Resources and Branding

April 1, 2015

2016PARENT COMPANY OF: QUAD CITY BANK & TRUST CEDAR RAPIDS BANK & TRUST ROCKFORD BANK & TRUST COMMUNITY BANK & TRUST m2 LEASE FUNDS

PARENT COMPANY OF: | QUAD CITY BANK & TRUST | CEDAR RAPIDS BANK & TRUST | ROCKFORD BANK & TRUST | COMMUNITY BANK & TRUST | m2 LEASE FUNDS |

QCR Holdings, Inc., a Delaware corporation (“QCR Holdings”), is the holding company for Quad City Bank and Trust Company, Cedar Rapids Bank and Trust Company, and Rockford Bank and Trust Company. Quad City Bank and Trust is an Iowa banking association located in Bettendorf, Iowa, with banking locations in Bettendorf and Davenport, Iowa and in Moline, Illinois. Quad City Bank and Trust owns m2 Lease Funds, LLC, a Wisconsin limited liability company based in Milwaukee, Wisconsin, that is engaged in the business of leasing machinery and equipment to businesses under direct financing lease contracts. Cedar Rapids Bank and Trust is an Iowa banking association located in Cedar Rapids, Cedar Falls and Waterloo, Iowa. Rockford Bank and Trust is an Illinois state bank located in Rockford, Illinois. QCR Holdings also owns all of the common stock of sixfive business trust subsidiaries that were created to issue trust preferred securities. When we refer to our “banking subsidiaries”“subsidiary banks” in this proxy statement, we are collectively referring to Quad City Bank and Trust, Cedar Rapids Bank and Trust, and Rockford Bank and Trust. When we refer to our “subsidiaries” in this proxy statement, we are collectively referring to our banking subsidiaries,subsidiary banks, as well as our other subsidiaries and business trusts. This proxy statement is furnished in connection with the solicitation by the board of directors of QCR Holdings of proxies to be voted at the annual meeting of stockholders to be held within the lobby of Quad City Bank and Trust Company, at the Rogalski Center at St. Ambrose University,our corporate office, located at 2100 N. Ripley3551 Seventh Street, Davenport, IA 52803,Moline, Illinois 61265, on Friday, May 15, 2015,13, 2016, at 10:8:00 a.m., local time, and at any adjournments or postponements of the meeting. This proxy statement and the accompanying form of proxy are first being transmitted or delivered to stockholders of QCR Holdings on or about April 1, 2015,2016, together with our 20142015 Annual Report to stockholders. The following is information regarding the meeting and the voting process, and is presented in a question and answer format. Why did I receive access to the proxy materials? We have made the proxy materials available to you over the internet because on March 25, 2015,23, 2016, the record date for the annual meeting, you owned shares of QCR Holdings common stock. This proxy statement describes the matters that will be presented for consideration by the stockholders at the annual meeting. It also gives you information concerning those matters to assist you in making an informed decision. The board is asking you to give us your proxy. Giving us your proxy means that you authorize another person or persons to vote your shares of our common stock at the annual meeting in the manner you direct. If you vote using one of the methods described herein, you appoint the proxy holder as your representative at the meeting, who will vote your shares as you instruct, thereby assuring that your shares will be voted whether or not you attend the meeting. Even if you plan to attend the meeting, you should vote by proxy in advance of the meeting in case your plans change. | | | If you sign and return your proxy card or vote over the internet or by telephone and an issue comes up for a vote at the meeting that is not identified in the proxy materials, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his or her judgment. Why did I receive a notice regarding the internet availability of proxy materials instead of paper copies of the proxy materials?

We are using the Securities and Exchange Commission notice and access rule that allows us to furnish our proxy materials over the internet to our stockholders instead of mailing paper copies of those materials to each stockholder. As a result, beginning on or about April 1, 2015,2016, we sent our stockholders by mail a notice containing instructions on how to access our proxy materials over the internet and vote online.This notice is not a proxy card and cannot be used to vote your shares. If you received a notice this year, you will not receive paper copies of the proxy materials unless you request the materials by following the instructions on the notice or on the website referred to on the notice. | | | | |

What matters will be voted on at the meeting? You are being asked to vote on:

● • the election of five Class III directors for a term expiring in 2018; ● a non-binding, advisory proposal to ratify the appointment of one Class III director for a term expiring in 2017;

● 2019;• a non-binding, advisory proposal to approve the compensation of certain executive officers, which is referred to as a “say-on-pay” proposal; • the QCR Holdings, Inc. 2016 Equity Incentive Plan (the “2016 Equity Incentive Plan”); • the ratification of an amendment to the Amended and ● Restated Rights Agreement, dated May 7, 2013, between QCR Holdings and Quad City Bank and Trust Company, as Rights Agent (the “Rights Agreement”); and• the ratification of the selection of our independent registered public accountants. If I am the record holder of my shares, how do I vote? You may vote by telephone, by internet, by mail by completing, signing, dating and mailing the proxy card you received in the mail, if you received paper copies of the proxy materials, or in person at the meeting. If you vote using one of the methods described above, your shares will be voted as you instruct. If you sign and return your proxy card or vote over the internet or by telephone without giving specific voting instructions, the shares represented by your proxy card will be voted “for” all nominees named in this proxy statement, and “for” each of the other proposals described in this proxy statement. Although you may vote by mail, we ask that you vote instead by internet or telephone, which saves us postage and processing costs. You may vote by telephone by calling the toll-free number specified on your proxy card ornoticeor by accessing the internet website referred to on your proxy card,notice, each by following the preprinted instructions on the proxy card.your notice. If you submit your vote by internet, you may incur costs, such as cable, telephone and internet access charges. Votes submitted by telephone or internet must be received by 11:59 p.m. EDT on Wednesday, May 13, 2015.11, 2016. The giving of a proxy by either of these means will not affect your right to vote in person if you decide to attend the meeting. | | | If you want to vote in person, please come to the meeting. We will distribute written ballots to anyone who wants to vote at the meeting. Please note, however, that if your shares are held in the name of a broker or other fiduciary (or in what is usually referred to as “street name”), you will need to arrange to obtain a legal proxy from that person or entity in order to vote in person at the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy card, or vote by telephone or internet, in advance of the meeting just in case your plans change. If I hold shares in the name of a broker or fiduciary, who votes my shares? If you received access to these proxy materials from your broker or other fiduciary, your broker or fiduciary should have given you instructions for directing how that person or entity should vote your shares. It will then be your broker or fiduciary’s responsibility to vote your shares for you in the manner you direct. Under the rules of various national and regional securities exchanges, brokers and fiduciaries generally may vote on routine matters, such as the ratification of the engagement of an independent public accounting firm, but may not vote on non-routine matters unless they have received voting instructions from the person for whom they are holding shares. The election and non-binding advisory ratification of directors, and the non-binding advisory proposal on executive compensation, the approval of the 2016 Equity Incentive Plan and the ratification of the amendment to the Rights Agreement are all non-routine matters, and consequently, your broker or fiduciary will not have discretionary authority to vote your shares on these matters. If your broker or fiduciary does not receive instructions from you on how to vote on these matters, your broker or fiduciary will return the proxy card to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a “broker non-vote” and may affect the outcome of the voting on those matters. | | | | |

We therefore encourage you to provide directions to your broker or fiduciary as to how you want your shares voted on all matters to be brought before the 20152016 annual meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the meeting. |

A number of banks and brokerage firms participate in a program that also permits stockholders to direct their vote by telephone or internet. If your shares are held in an account at such a bank or brokerage firm, you may vote your shares by telephone or internet by following the instructions on their enclosed voting form. If you submit your vote by internet, you may incur costs, such as cable, telephone and internet access charges. Voting your shares in this manner will not affect your right to vote in person if you decide to attend the meeting, however, you must first request a legal proxy from your broker or other fiduciary. Requesting a legal proxy prior to the deadline stated above will automatically cancel any voting directions you have previously given by internet or by telephone with respect to your shares. What does it mean if I receive more than one notice card? It means that you have multiple holdings reflected in our stock transfer records or in accounts with brokers. To vote all of your shares by proxy, please follow the separate voting instructions that you received for the shares of common stock held in each of your different accounts. What if I change my mind after I vote? If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by: ● • signing another proxy with a later date and returning that proxy to us; ● • timely submitting another proxy via the telephone or internet; ● • sending notice to us that you are revoking your proxy;proxy, to Shellee R. Showalter, SVP, Director of Investor Services, QCR Holdings, Inc., 3551 Seventh Street, Moline, IL 61265; or ● • voting in person at the meeting. | | | If you hold your shares in the name of your broker or through a fiduciary and desire to revoke your proxy, you will need to contact that person or entity to revoke your proxy. | | | How many votes do we need to hold the annual meeting? A majority of the shares that are outstanding and entitled to vote as of the record date must be present in person or by proxy at the meeting in order to hold the meeting and conduct business. Shares are counted as present at the meeting if the stockholder either: ● either is present in person at the meeting;meeting or

● has properly submitted a signed proxy card or other proxy.

On March 25, 2015,23, 2016, the record date, there were 7,989,514[11,8xx,xxx] shares of common stock outstanding. Therefore, at least 3,994,758[5,9xx,xxx] shares need to be present in person or by proxy at the annual meeting in order to hold the meeting and conduct business. What happens if a nominee is unable to stand for election? The board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. Proxies cannot be voted for more than the number of nominees presented for election at the meeting. The board has no reason to believe any nominee will be unable to stand for election. What options do I have in voting on each of the proposals? You may vote “for” or “withhold authority to vote for” each nominee for director. You may vote “for,” “against” or “abstain” on each of the other proposals described in this proxy statement and on any other proposal that may properly be brought before the meeting. | | | | |

How many votes may I cast? Generally, you are entitled to cast one vote for each share of stock you owned on the record date. |

How many votes are needed for each proposal? Our directors are elected by a plurality of the votes of the shares present in person or by proxy and entitled to vote and the five individuals receiving the highest number of votes cast “for” their election will be elected as Class III directors of QCR Holdings. A “withhold authority to vote for” and broker non-votes will have no effect on the election of any director at the annual meeting. Approval of the advisorysay-on-pay proposal, the 2016 Equity Incentive Plan, the ratification of the Class III director,amendment to the say-on-pay proposal,Rights Agreement, the ratification of the appointment of McGladreyRSM US LLP as our independent registered public accounting firm, and, in general, any other proposals, must receive the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. Abstentions will have the effect of voting against these proposals. On all matters, broker non-votes will not be counted as entitled to vote, but will count for purposes of determining whether or not a quorum is present. Because the ratification of the Class III director and the say-on-pay proposal areis advisory, the outcome of such votesvote will not be binding on the board of directors. Also, please remember that the election and non-binding advisoryof directors, the approval of the 2016 Equity Incentive Plan, the ratification of directors,the amendment to the Rights Agreement, and the non-binding, advisory proposal on executive compensation are each considered to be non-routine matters. As a result, if your shares are held by a broker or other fiduciary, it cannot vote your shares on these matters unless it has received voting instructions from you. Where do I find the voting results of the meeting? If available, we will announce voting results at the meeting. The voting results will also be disclosed on a Form 8-K that we will file within four business days after the annual meeting. | | | Who bears the cost of soliciting proxies? We will bear the cost of soliciting proxies. In addition to solicitations by mail, officers, directors or employees of QCR Holdings or of our subsidiaries may solicit proxies in person or by telephone. These persons will not receive any special or additional compensation for soliciting proxies. We may reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. | | | The Securities and Exchange Commission has issued rules regarding the delivery of proxy statements and information statements to households. These rules spell out the conditions under which annual reports, information statements, proxy statements, prospectuses and other disclosure documents of a particular company that would otherwise be mailed in separate envelopes to more than one person at a shared address may be mailed as one copy in one envelope addressed to all holders at that address (i.e., “householding”). To conserve resources and reduce expenses, we consolidate materials under these rules when possible. However, because we are using the Securities and Exchange Commission notice and access rule for the annual meeting, we will not household our proxy materials or notices to stockholders of record sharing an address. This means that stockholders of record who share an address will each be mailed a separate notice of the proxy materials. However, certain brokerage firms, banks, or similar entities holding our common stock for their customers may household proxy materials or notices. Stockholders sharing an address whose shares of our common stock are held in street name should contact their broker if they now receive: (i) multiple copies of our proxy materials or notices and wish to receive only one copy of these materials per household in the future; or (ii) a single copy of our proxy materials or notice and wish to receive separate copies of these materials in the future. If at any time you would like to receive a paper copy of our Annual Report or proxy statement, please write to Shellee R. Showalter, SVP, Director of Investor Relations,Services, QCR Holdings, Inc., 3551 Seventh Street, Moline, IL 61265, or call us at (309) 736-3584. | | | | |

Our directors are divided into three classes having staggered terms of three years. At the annual meeting, stockholders will be asked to elect five Class III directors for a term expiring in 2018.2019. The board has considered and nominated current directors JamesPatrick S. Baird, Larry J. Brownson, Lindsay Y. Corby, Todd A. Gipple,Helling, Douglas M. Hultquist, Mark C. Kilmer and Donna J. Sorensen and has nominated one new individual, John-Paul E. Besong,Linda K. Neuman, to serve as Class III directors of QCR Holdings. We have no knowledge that any of the nominees will refuse or be unable to serve, but if any of the nominees becomes unavailable for election, the holders of the proxies reserve the right to substitute another person of their choice as a nominee when voting at the meeting. Set forth below is information concerning the nominees for election and for each of the other persons whose terms of office will continue after the meeting, including age, year first elected a director and business experience during the previous five years. Directors are elected by a plurality and the five individuals receiving the highest number of votes cast for their election will be elected as Class III directors.Our board of directors unanimously recommends that you vote your shares “FOR” all of the nominees for directors. Name -– (Age) | | Positions with QCR Holdings and Subsidiaries | | NOMINEES | CLASS I (New Term Expires 2018) | | John-Paul E. Besong - (Age 61) | - | Nominee for Director of QCR Holdings | | | | CLASS II (Term Expires 2019) | James J. Brownson Patrick S. Baird - (Age 69)62) | 19972010 | Vice Chair of the Board and Director of QCR Holdings; Vice Chair of the Board and Director of Cedar Rapids Bank and Trust; Director of m2 Lease Funds | | Larry J. Helling - (Age 60) | 2001 | Director of QCR Holdings; President, Chief Executive Officer and Director of Cedar Rapids Bank and Trust; Director of Quad City Bank and Trust; Director of m2 Lease Funds | | Douglas M. Hultquist - (Age 60) | 1993 | President, Chief Executive Officer and Director of QCR Holdings; Director of Quad City Bank and Trust; Director of Rockford Bank and Trust; Director of m2 Lease Funds | | Mark C. Kilmer - (Age 57) | 2004 | Director of QCR Holdings; Chair of the Board and Director of Quad City Bank and Trust | | Linda K. Neuman - (Age 67) | 2013 | Director of QCR Holdings, Vice Chair of the Board and Director of Quad City Bank and Trust | | | | | | | | |

| Name – (Age) | Director Since | Positions with QCR Holdings and Subsidiaries | | CONTINUING DIRECTORS | | CLASS III (Term Expires 2017) | | Michael L. Peterson - (Age 54) | 2013 | Director of QCR Holdings | | Ronald G. Peterson - (Age 72) | 1993 | Director of QCR Holdings; Director of Quad City Bank and Trust | | George T. Ralph III - (Age 56) | 2015 | Director of QCR Holdings; Chair of the Board and Director of Rockford Bank and Trust | | Marie Z. Ziegler - (Age 58) | 2008 | Director of QCR Holdings; Director of Quad City Bank and Trust |

| Name - (Age) | Director

Since | Positions with QCR Holdings and Subsidiaries | | CONTINUING DIRECTORS | | CLASS I (New Term Expires 2018) | | | John-Paul E. Besong - (Age 62) | 2015 | Director of QCR Holdings | | James J. Brownson - (Age 70) | 1997 | Chair of the Board and Director of QCR Holdings | Lindsay Y. Corby - (Age 37)38) | 2012 | Director of QCR Holdings | | | | | Todd A. Gipple - (Age 51)52) | 2009 | Director of QCR Holdings; Executive Vice President, Chief Operating Officer, and Chief Financial Officer of QCR Holdings; Director of Quad City Bank and Trust; Director of Cedar Rapids Bank and Trust; Director of Rockford Bank and Trust | | | | | Donna J. Sorensen - (Age 65)66) | 2009 | Director of QCR Holdings; Chair of the Board and Director of Cedar Rapids Bank and Trust |

Name – (Age) | Director

Since

| Positions with QCR Holdings and Subsidiaries | CONTINUING DIRECTORS | CLASS II (Term Expires 2016) | Patrick S. Baird - (Age 61) | 2010 | Vice Chair of the Board and Director of QCR Holdings; Vice Chair of the Board and Director of Cedar Rapids Bank and Trust | | | | Larry J. Helling - (Age 59) | 2001 | Director of QCR Holdings; President, Chief Executive Officer and Director of Cedar Rapids Bank and Trust; Director of Quad City Bank and Trust; Director of m2 Lease Funds | | | | Douglas M. Hultquist - (Age 59) | 1993 | President, Chief Executive Officer and Director of QCR Holdings; Director of Quad City Bank and Trust; Director of Rockford Bank and Trust; Director of m2 Lease Funds | | | | Mark C. Kilmer - (Age 56) | 2004 | Director of QCR Holdings; Chair of the Board and Director of Quad City Bank and Trust | | | | Linda K. Neuman - (Age 66) | 2013 | Director of QCR Holdings, Vice Chair of the Board and Director of Quad City Bank and Trust |

Name – (Age) | Director

Since

| Positions with QCR Holdings and Subsidiaries | CONTINUING DIRECTORS | CLASS III (Term Expires 2017) | | | Michael L. Peterson - (Age 53) | 2013 | Director of QCR Holdings | | | | Ronald G. Peterson - (Age 71) | 1993 | Director of QCR Holdings; Director of Quad City Bank and Trust | | | | George T. Ralph III - (Age 55) | 2015 | Director of QCR Holdings; Chair of the Board and Director of Rockford Bank and Trust | | | | Marie Z. Ziegler - (Age 57) | 2008 | Director of QCR Holdings; Director of Quad City Bank and Trust |

In January 2015, QCR Holdings director and Rockford Bank and Trust Chair, John D. Whitcher, passed away. Mr. Whitcher was a director of Rockford Bank and Trust since its formation in January 2005, and was named its Chair in May 2009. He joined the QCR Holdings board in May 2008 and served as Chair of the Compensation Committee. On February 12, 2015, the board appointed George T. Ralph III as a Class III director to fill the vacancy created by Mr. Whitcher’s passing, and appointed Ms. Neuman as Chair of the Compensation Committee.

All of our continuing directors and nominees will hold office for the terms indicated, or until their earlier death, resignation, removal, disqualification, or ineligibility due to exceeding age eligibility requirements (a person who has reached the age of 72 before the date of the annual meeting is not eligible for election to the board) and until their respective successors are duly elected and qualified. All of our executive officers hold office for a term of one year. There are no arrangements or understandings between any of the directors, executive officers or any other person pursuant to which any of our directors or executive officers have been selected for their respective positions. Messrs. Hultquist and Besong are directors of United Fire Group, Inc., a company subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Mr. Baird was a director of National Financial Partners Corp., a company with securities registered undersubject to the reporting requirements of the Exchange Act, from October 2011 until July 2013. No other nominee or director has been a director of another company subject to the reporting requirements of the Exchange Act within the past five years. The business experience of each of the nominees and continuing directors for the past five years, as well as their qualifications to serve on the board, are as follows:

Patrick S. Baird is the retired President and Chief Executive Officer of AEGON USA, LLC, the U.S. subsidiary of the AEGON Insurance Group, a leading multinational insurance organization. He currently servescontinues to serve the company as Co-Chairmanwith certain projects and is currently assisting the company with its expansion activities in Latin America. Mr. Baird joined the AEGON USA companies in 1976, and during his career also served as Executive Vice President and Chief Operating Officer, Chief Financial Officer and Chief Tax Officer. He is a graduate of the University of Iowa, and is a Certified Public Accountant.Accountant (inactive). Mr. Baird is a Commissioner for the Eastern Iowa Airport and is a founding board member and Treasurer of the Zach Johnson Foundation. He is also a director of Lombard International, a specialty life insurance company based in Philadelphia, Pennsylvania. Since its formation in 2011, Mr. Baird has been a director of Cedar Rapids Bank and Trust sincewhere he currently serves as Chair of its formation in 2001.Loan Committee. We consider Mr. Baird to be a qualified candidate for service on the board and on the committees he is a member of due to his experience as the President and Chief Executive Officer of a successful insurance company in Cedar Rapids, Iowa, one of our market areas, his knowledge of the business community in this area and his broad based financial acumen.John-Paul E. Besong is a former Senior Vice President of e-Business and Chief Information Officer for Rockwell Collins, a Fortune 500 company based in Cedar Rapids, Iowa, that provides aviation electronics for both commercial and military aircraft. He was appointed Senior Vice President and Chief Information Officer in 2003. Beginning in 1979, when he joined Rockwell Collins as a chemical engineer, Mr. Besong has held management roles having increasingly more responsibility within the company including, vice president of e-Business and Lean ElectronicsSM, head of the SAP initiative and Director of the Printed Circuits and Fabrication businesses. Mr. Besong serves on the boards of directors of Lean Aerospace Initiative (LAI),United Fire Group, Junior Achievement (Cedar Rapids area), Mercy Medical Center, Iowa Public Television Foundation and Technology Association of Iowa (TAI) CIO Advisory Board.Board, and is a former director of Lean Aerospace Initiative (LAI). He also serves as a member and former chair of the executive board of TAI. We consider Mr. Besong to be a qualified candidate for service on the board and the committees he will be placed on due to his business acumen and distinguished management career as an officer and information technology expert of a Fortune 500 company.James J. Brownson is the retired President of W.E. Brownson Co., a manufacturers’ representative agency located in Eldridge, IowaDavenport, Iowa. For 37 years he was involved in the sale of custom engineered products to OEM manufacturers in the Midwest, and hashad been in that position since 1978. Mr. Brownson is a graduate of St. Ambrose University, Davenport, Iowa and the Graduate School of Banking, University of Wisconsin, Madison, Wisconsin. He began his career in 1967 as a member of the audit staff at Arthur Young & Co., in Chicago, Illinois. From 1969 until 1978, Mr. Brownson was employed by Davenport Bank and Trust Company, where he left as Senior Vice President and Cashier. He is a past member of the National Sales Representative Council of Crane Plastics, Columbus, Ohio, and Dayton Rogers Manufacturing Co., Minneapolis, Minnesota. Mr. Brownson has been a featured speaker at nationalBank Director Magazine andSNL Financial conferences on the role of the board of directors in executive compensation and strategic planning, and the strategic role of board of directors in successful community banking. Mr. Brownson has served on the board of directors of the United Way of the Quad Cities, Junior Achievement of the Quad Cities, St. Ambrose University Alumni Association and United Cerebral Palsy of the Quad Cities. Mr. Brownson has beenwas a director of Quad City Bank and Trust sincefrom its formation in October 1993.1993 until his retirement in May 2015. Mr. Brownson has announced his plans to retire as Chair of the board of directors of QCR Holdings in May 2016 but will continue to serve as a member of the board. We consider Mr. Brownson to be a qualified candidate for service on the board and the committees he is a member of due to his experience as the President of a successful manufacturer’s representative business in Davenport, Iowa, one of our market areas, his prior experience in banking and public accounting, his educational background in banking, his participation in numerous national banking conferences, and his knowledge of the business community throughout the Midwest.

Lindsay Y. Corby is the Chief AdministrativeFinancial Officer at Byline Bank, the banking subsidiary of Byline Bancorp, Inc., located in Chicago, Illinois. She joined the management team of Byline (formerly known as North Community Bank, a wholly owned subsidiary of Metropolitan Bank Group, Inc.) on June 28, 2013, at the time of a $207 million recapitalization by a group of individual investors. Prior to joining Byline Bank, she was a Principal at BXM Holdings, Inc., a financial services company based in Chicago, Illinois, formed to facilitate recapitalization transactions in depository institutions. During her time at BXM, she worked as part of the investor representative team to facilitate the recapitalization of Metropolitan Bank Group, Inc. Ms. Corby joined BXM Holdings, Inc. in February 2011. Prior to joining BXM Holdings, Ms. Corby was a Vice President in the investment banking group of Keefe, Bruyette & Woods, holding various positions since 2001. During her years at KBW, she focused on mergers and acquisitions, capital markets transactions, complex recapitalizations and valuation activities for U.S. financial institutions. Prior to joining KBW, Ms. Corby worked at Merrill Lynch as an analyst in its Technology Investment Banking Group. Ms. Corby received an M.S. in Accounting, a B.A. in Spanish and a B.B.A. in Accounting from Southern Methodist University. Ms. Corby is a graduate of the Kellogg Executive Education, Women's Senior Leadership Program, and is a Certified Public Accountant.Accountant (inactive). We consider Ms. Corby to be a qualified candidate for service on the board and the committees she is a member of due to her experience in the investment banking area advising financial institutions and her education and training.

Todd A. Gipple is a Certified Public Accountant (inactive) and began his career with KPMG Peat Marwick in 1985. In 1991, McGladrey & Pullen acquired the Quad Cities practice of KPMG. Mr. Gipple was named Tax Partner with McGladrey & Pullen in 1994 and served as the Tax Partner-in-Charge of the firm’s Mississippi Valley Practice and as one of five Regional Tax Coordinators for the national firm. He specialized in Financial Institutions Taxation and Mergers and Acquisitions throughout his 14-year career in Public Accounting. He joined QCR Holdings in January of 2000, and currently serves as Executive Vice President, Chief Operating Officer and Chief Financial Officer. He also serves as a Director of Quad City Bank and Trust, Cedar Rapids Bank and Trust, and Rockford Bank and Trust. Mr. Gipple previously served on the board of directors and the Executive Committee of the Davenport Chamber of Commerce, United Way of the Quad Cities and the Scott County Beautification Foundation, and was a member of the original Governing Body for the Quad City’s “Success by 6” Initiative. Mr. Gipple is the 2016 Chief Corporate Chair for the Quad Cities JDRF One Walk and also currently serves on the Audit Committee for the Community Foundation of the Great River Bend, the board of directors of SAL Family and Community Services, the board of directors of the Scott County family YMCA, and is a member of the American Institute of CPAs. We consider Mr. Gipple to be a qualified candidate for service on the board and the committees he is a member of due to his experience as the Chief Financial Officer and Chief Operating Officer of QCR Holdings and his prior experience as a tax partner in public accounting.

Larry J. Helling was previously the Executive Vice President and Regional Commercial Banking Manager of Firstar Bank in Cedar Rapids with a focus on the Cedar Rapids metropolitan area and the Eastern Iowa region. Prior to his six years with Firstar, Mr. Helling spent twelve years with Omaha National Bank. Mr. Helling is a graduate of the Cedar Rapids’ Leadership for Five Seasons program and currently serves on the board of directors and trustees of the United Way of East Central Iowa and the board of trustees of Junior Achievement. He is past President and a member of the Rotary Club of Cedar Rapids, on the board of the Entrepreneurial Development Center, and is on the board of Brucemore National Trust Historic Site. He also serves as a Director of Quad City Bank and Trust, Cedar Rapids Bank and Trust, and m2 Lease Funds. We consider Mr. Helling to be a qualified candidate for service on the board and the committees he is a member of due to his experience as the President of Cedar Rapids Bank and Trust, his past experience as an executive officer of Firstar Bank, located in Cedar Rapids, Iowa, one of our market areas, and his prior banking experience.

Douglas M. Hultquist is a certified public accountantCertified Public Accountant (inactive) and previously served as a tax partner with two major accounting firms. He began his career with KPMG Peat Marwick in 1977 and was named a partner in 1987. In 1991, the Quad Cities office of KPMG Peat Marwick merged with McGladrey & Pullen. Mr. Hultquist served as a tax partner in the Illinois Quad Cities office of McGladrey & Pullen from 1991 until co-founding QCR Holdings in 1993. During his public accounting career, Mr. Hultquist specialized in bank taxation, taxation of closely held businesses, and mergers and acquisitions. He received his undergraduate degree from Augustana College in Accounting and Economics in 1977 and in 2009 received an Honorary Doctorate degree from the college. Mr. Hultquist served on the board of directors of the PGA TOUR John Deere Classic and was its chairman for the 2001 tournament. He is a past chairman of the Augustana College Board of Trustees, past president of the Quad City Estate Planning Council, past finance chairman of Butterworth Memorial Trust and previously served on the board of the Illinois Bankers Association. Mr. Hultquist currently serves on the board of United Fire Group, Inc., and is chair of its Risk Management Committee. He is a member of the Quad Cities Chamber of Commerce board of directors and Executive Committee and past chair of its board. He is a board member of the Rock Island County Children’s Advocacy Center and participates in Big Brothers/Big Sisters. Mr. Hultquist also serves as a director of Quad City Bank and Trust, Rockford Bank and Trust, and m2 Lease Funds. Mr. Hultquist received the 1998 Ernst & Young “Entrepreneur of the Year” award for the Iowa and Nebraska region and was inducted into the Quad Cities Area Junior Achievement Business Hall of Fame in 2003. He is also a member of the American Institute of CPAs and the Iowa Society of CPAs, and was selected as the Iowa Society of CPAs’ Outstanding CPA in Business and Industry for 2011. Mr. Hultquist was also recognized as a 2015 Male Champion of Change Honoree by Women’s Connection.Connection and the 2016 Mardi Gras King by Junior Board of Rock Island. We consider Mr. Hultquist to be a qualified candidate for service on the board and the committees he is a member of due to his experience as the President and Chief Executive Officer of QCR Holdings and his prior public accounting experience as a tax partner.Mark C. Kilmer is President of The Republic Companies, a family-owned group of businesses founded in 1916 and headquartered in Davenport, Iowa involved in the wholesale equipment and supplies distribution of energy management, electrical, refrigeration, heating, air-conditioning and sign support systems. Prior to joining Republic in 1984, Mr. Kilmer worked in the Management Information Systems Department of Standard Oil of California (Chevron) in San Francisco. Mr. Kilmer currently is a board member of The Genesis Health System, serves on the Board of Trustees of St. Ambrose University, and also serves on the board of directors of IMARK Group, Inc., a national member-owned purchasing cooperative of electric supplies and equipment distributors. He is a two-term past Chairmanchairman of the PGA TOUR John Deere Classic and the past Chairmanchairman of the Scott County YMCA’s board of directors. Mr. Kilmer is the past Chairmanchairman of the board of Genesis Medical Center, and has served on the board of directors of The Genesis Heart Institute, St. Luke’s Hospital, Rejuvenate Davenport, The Vera French Foundation and Trinity Lutheran Church. He was a four-time project business consultant for Junior Achievement. Mr. Kilmer has been a director of Quad City Bank and Trust since February 1996 and named its Chair in January 2007. Prior to joining the board of Quad City Bank and Trust in 1996, Mr. Kilmer served on the board of Citizen’s Federal Savings Bank in Davenport, Iowa. He currently serves as the Chair of the Board of Quad City Bank and Trust, and is a member of its Loan Committee. In 2014, Mr. Kilmer was named the Outstanding Volunteer Fundraiser by Quad City Chapter of the Association of Fundraising Professionals, and along with his wife, Kathy, received the Bethany Homes Leadership Family of the Year Award. We consider Mr. Kilmer to be a qualified candidate for service on the board and the committees he is a member of due to his experience as the President of a successful wholesale and supply distribution business in Davenport, Iowa, one of our market areas, prior service on a bank board and his knowledge of the business community in this area.

Linda K. Neuman is a retired member of the Iowa Supreme Court, having served as a trial and appellate judge for more than twenty years. She holds undergraduate and law degrees from the University of Colorado as well as a Masters in Law degree from the University of Virginia College of Law. Prior to her service in the judiciary, Ms. Neuman was a partner in the Davenport, Iowa law firm of Betty, Neuman & McMahon PLC, and served as Vice President and Trust Officer at the former Bettendorf Bank and Trust Company (now Wells Fargo). She is certified in mediation and arbitration, the current focus of her private practice. For the past ten years, Ms. Neuman has beenis a member of the adjunct faculty of University of Iowa College of Law, where she pioneered its judicial extern program and has taught courses in professional ethics and appellate practice. She has been active in statewide and national professional and civic organizations including the American Bar Association, National Association of Women Judges, Uniform Laws Commission, Iowa State Bar Association, Quad Cities United Way and DavenportOne. She is a past President of the American Academy of ADR Attorneys. She served two terms on the board of directors of Royal Neighbors of America, a fraternal benefit and financial services organization headquartered in Rock Island, Illinois, where she chaired the governance committee and served on the audit and investment committees. In 2009 she was honored with a Quad City Athena Business Women’s Award and in 2013 received the Iowa State Bar Association’s President’s Award. She is a director on the board of the Community Foundation of the Great River Bend and a trustee, emeritus, of St. Ambrose University. Since 2008, Ms. Neuman has been a director of Quad City Bank and Trust where she currently serves as Vice Chair of its board and a member of its Wealth Management Committee. In 2009, she was honored with a Quad City Athena Business Women’s Award, in 2013 received the Iowa State Bar Association’s President’s Award and, in 2015, she was inducted by Gov. Terry Branstad into the Iowa Women’s Hall of Fame. We consider Ms. Neuman to be a qualified candidate for service on the QCR Holdings board based on her legal and judicial background, her experience with other financial services organizations, and her commitment to civic and professional organizations within our market area.

Michael L. Peterson is owner and President of Peterson Genetics, Inc., based in Cedar Falls, Iowa, providing soybean genetics to seed companies worldwide for over 25 years. Mr. Peterson is a graduate of Iowa State University with a B.S. in Agricultural Business. He is a past President of the Iowa Seed Association, past Chair of the Soybean Division of the American Seed Trade Association and past Chairmanchairman of the American Seed Trade Association. Mr. Peterson is also the past ChairmanChair of Community National Bank (which was acquired by QCR Holdings Inc. in 2013). We consider Mr. Peterson to be a qualified candidate for service on the board due to his experience in the banking industry and his business connections in and extensive knowledge of our market areas.

Ronald G. Peterson is thea retired President and Chief Executive Officer of the First State Bank of Illinois, located in Peoria, Illinois. Prior to his retirement, he served in that position since 1982. Mr. Peterson servespreviously served on the board of directors of First State Bank of Illinois, and iswas former Treasurer and Vice President of First State Bancorporation, Inc. He has served on the board of directors of the Illinois Bankers Association and in 2005 was named Illinois Banker of the Year. Mr. Peterson also served on various committees of the American Bankers Association and served as President of the Western Illinois Bank Management Association and the Hancock County Bankers Association. He has served on boards of, and has had leadership positions with, numerous civic and philanthropic organizations, including President of the Western Illinois University Foundation, President of the La Harpe Educational Foundation, Chairmanchairman of the McDonough District Hospital Development Council and President of the Macomb Rotary Club. Since its inception in 1993, Mr. Peterson has been a member of the board of directorsdirector of Quad City Bank and Trust since its inception in 1993. He iswhere he currently serves as Chair of theits Loan Committee at Quad City Bank and Trust.a member of its Asset/Liability Management Committee. We consider Mr. Peterson to be a qualified candidate for service on the board and the committees he is a member of due to his experience in the banking industry serving as the President and Chief Executive Officer of First State Bank of Illinois.

George T. Ralph III is the founder of GTR Realty Advisors, LLC. This commercial real estate company was established in 2006 and specializes in development, redevelopment and related financing alternatives. Prior to founding GTR, Mr. Ralph was Chief Financial Officer of Erickson Associates, Inc., a full-service commercial real estate company based in Rockford, Illinois, and also served as President of GTR Mortgage Services, Inc., an affiliated company specializing in commercial real estate finance. During his 10-year stay with the company, Mr. Ralph’s duties included ascertaining the economic feasibility of all new development projects, preparing all new project proposals for negotiation with prospective clients, negotiating lease agreements, arranging interim construction financing for new projects and permanent financing for completed projects. From July 1984 until joining Erickson in June 1996, Mr. Ralph was actively employed in the commercial mortgage banking industry in Chicago, Illinois. During his time in this industry, he was engaged in all aspects of the business including the traditional third party placement of income property loans, direct lending in the form of interim construction loans, gap financing and permanent loans and managing loan servicing portfolios for third party institutional investors. In carrying out these duties, he was responsible for selling participating interests in direct loans to various institutional investors as well as negotiating multi-million dollar revolving lines of credit with several major lending institutions. Prior to entering the mortgage banking industry in 1984, Mr. Ralph was employed by Price Waterhouse in the company’s Chicago office. He joined the company following graduation from college in 1981 and advanced to Senior Accountant before leaving the company in 1984. During his time with Price Waterhouse, he was a member of the general audit staff that provided audit services to large corporate clients.office for three years. Mr. Ralph earned a B.S. in Accounting from Illinois State University and is areceived his Certified Public Accountant.Accountant designation in 1982. He has served on numerous nonprofit boards over the years and is currently a member of the leadership team for Boylan Central Catholic High School’s Capital Campaign. HeSince 2009, Mr. Ralph has been a director of Rockford Bank and Trust since 2009, andwhere he currently serves as Chair of its board, as well as serving onand a member of its Loan, Asset/Liability Management and Asset/LiabilityWealth Management Committees. We consider Mr. Ralph to be a qualified candidate for service on the board and the committees he is a member of due to his experience as a real estate developer and mortgage banker in the commercial real estate industry throughout the Midwest including Rockford, Illinois, one of our market areas, his knowledge of the business community in this area and his education and training as an accountant.

Donna J. Sorensen is President of Sorensen Consulting, a management consulting and executive coaching firm. Ms. Sorensen earned her undergraduate degree from Marycrest College and her Juris Doctorate degree from the University of Iowa College of Law. She has twenty years of prior experience in trust and investment management serving as Executive Vice President Institutional Trust for U.S. Bank (formerly Firstar Bank). Ms. Sorensen has served on numerous nonprofit boards over the years and is currently a board member of the University of Iowa Obermann Center for Advanced Research, Kirkwood Community College Foundation Investment Committee and the Greater Cedar Rapids Community Foundation Agency Investment Advisory Council, and is a member of the Iowa State Bar Association. SheSince 2008, Ms. Sorensen has been a director of Cedar Rapids Bank and Trust since 2002, andwhere she currently serves as Chair of its board as well as serving onand a member of its Loan and Wealth Management Committees. We consider Ms. Sorensen to be a qualified candidate for service on the board and the committees she is a member of due to her experience as the President of a consulting firm in Iowa City, Iowa, her prior banking experience and her education and training as an attorney.

Marie Z. Ziegler is a retired Vice President and Deputy Financial Officer of Deere & Company. In this role, she had responsibility for Deere’s global treasury, pensionsCompany and investments, and investor relations. Prior to this, Ms. Ziegler was previously Deere’s Vice President and Treasurer. She joined Deere & Company in 1978 as a consolidation accountant and held management positions in finance, treasury operations, strategic planning and investor and banking relations. Ms. Ziegler is a 1978 graduate of St. Ambrose University, with a bachelor of arts in accounting. She received her Certified Public Accountant designation in 1979 and an MBA from the University of Iowa in 1985. Ms. Ziegler is on the board of trustees for the Two Rivers YMCA (Moline, Illinois)where she currently serves as chair and member of the Finance Committee. She is also a member of the Community Foundation of the Great River Bend where she serves as Investment Committee Chair. Ms. Ziegler is on the board of UnityPoint Health-Trinity.Unity Point Health-Trinity and also serves on the Executive, Finance and Quality and Cost of Care Committees. She is Co-Chair of the Unity Point Birthplace campaign and Chair of Trinity Health Enterprises. Ms. Ziegler is a member of the Riverboat Development Authority and serves on the St. Ambrose University College of Business Alumni Advisory Council. Ms. Ziegler previously served on the following boards: United Way, John Deere Foundation, Trinity Regional Health Systems, Trinity North Hospital/Trinity Medical Center, Mississippi Valley Girl Scout Council, Deere & Company Employees Credit Union and Community Foundation of the Great River Bend. She is past Chair of fundraising for Playcrafters Barn Theatre and a past member of the University of Iowa College of Business’ Tippie Advisory Board, Unified Growth Strategy CommitteeBoard. Since 2010, Ms. Ziegler has been a director of the Illinois Quad City Chamber of Commerce, Girl Scouts of the Mississippi Valley, Inc., Trinity Regional Health System, Trinity Medical CenterBank and Community Foundation of the Great River Bend. She also served on the Deere & Company Credit Union board, andTrust where she currently serves as a member of the board of the United Way of the Quad Cities, chairing its 2003 Quad Cities United Way Campaign. She also is past treasurer of fundraising for Playcrafters Barn Theatre, Moline.Asset/Liability Management Committee. In 2006 Ms. Ziegler is also involvedwas honored with a number of charitable organizations headquartered in communities served by QCR Holdings, providing her with business connections and extensive knowledge of our market areas.Quad City Athena Business Women’s Award. We consider Ms. Ziegler to be a qualified candidate for service on the board and the committees she is a member of due primarily to the knowledge and experience regarding public companies she gained in her role as Vice President and Treasurer of Deere & Company.Company, as well as her involvement with a number of charitable organizations headquartered in communities served by QCR Holdings, providing her with business connections and extensive knowledge of our market areas. Our executive officers consist of Douglas M. Hultquist, Todd A. Gipple and Larry J. Helling, each of whom is also a director of QCR Holdings, as well as John H. Anderson, Thomas D. Budd and Cathie S. Whiteside. Mr. Hultquist has served as the President and Chief Executive Officer of QCR Holdings since 1993;1993. Mr. Gipple has served as the Executive Vice President, Chief Operating Officer and Chief Financial Officer since 2008, and he previously served as Executive Vice President and Chief Financial Officer since 2000;2000. Mr. Helling has served as President and Chief Executive Officer of Cedar Rapids Bank and Trust since 2001;2001. Mr. Anderson (age 51) has served as President and Chief Executive Officer of Quad City Bank and Trust since 2007, and he previously served as Senior Vice President, Business Development since 1998;1998. Mr. Budd (age 53) has served as President and Chief Executive Officer of Rockford Bank and Trust since 2005; and2005. Ms. Whiteside (age 59) has served as Executive Vice President, Corporate Strategy, Human Resources and Branding since 2013, and she previously served as Executive Vice President, Corporate Strategy and Branding since 2007. PROPOSAL 2:

ADVISORY (NON-BINDING) VOTE TO RATIFY APPOINTMENT OF DIRECTOR

According to our bylaws, vacancies on the board may be filled by the affirmative vote of a majority of the remaining directors, including vacancies created by the death of a sitting director. A director elected by the board to fill a vacancy in a class shall serve for the remainder of the full term of that class and until the director’s successor is elected and qualified. At a regular meeting of the board on February 12, 2015, the board, upon the recommendation of the Nomination and Governance Committee, appointed George T. Ralph III to the board, effective February 12, 2015, to fill the vacancy created by the passing of John D. Whitcher. Based on Mr. Ralph’s experience in the community, his strong educational background and his service on the board of Rockford Bank and Trust, we believe he is a valuable member of our board.

Because our bylaws require that each of the three classes of directors be as near to equal in size as possible, the board was unable to appoint Mr. Ralph to the class of the directors that is up for election at our 2015 annual meeting of stockholders. Mr. Ralph was appointed to fill a vacancy in Class III, to hold office until the 2017 annual meeting of stockholders, until his successor is duly elected and qualified, or, if sooner, until his death, resignation or removal. However, the Nomination and Governance Committee and the full board believe that, in keeping with our commitment to good corporate governance practices, it is appropriate for the appointment of Mr. Ralph to be ratified by the stockholders in an advisory manner at the first opportunity. Therefore, based on the recommendation of the Nomination and Governance Committee, on February 12, 2015, the board adopted a resolution to include a proposal at the 2015 annual meeting for our stockholders to vote, on an advisory basis, to ratify the appointment of Mr. Ralph to the board. If less than a majority of the votes cast at the 2015 annual meeting of stockholders approve the ratification of the appointment, the Nomination and Governance Committee will consider whether to ask Mr. Ralph to resign from the board. If the Nomination and Governance Committee recommends that he resigns, and if the board accepts such resignation, Mr. Ralph will no longer be a member of our board and the board may appoint a replacement to fill the vacancy or decrease the number of directors to eliminate the vacancy.

The board of directors unanimously recommends that you vote to approve the ratification of George T. Ralph III to the QCR Holdings board of directors by voting “FOR” this proposal.

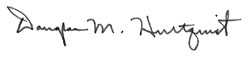

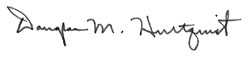

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS Generally, the board oversees our business and monitors the performance of our management. In accordance with our corporate governance procedures, the board does not involve itself in the day-to-day operations of QCR Holdings, which is monitored by our executive officers and management. Our directors fulfill their duties and responsibilities by attending regular meetings of the full board, which are held no less frequently than quarterly. Our directors also discuss business and other matters with Mr. Hultquist, our Chief Executive Officer, other key executives and our principal external advisors (legal counsel, auditors and other consultants). Director Ralph was appointed to the board on February 12, 2015 to fill the vacancy created by the death of John D. Whitcher. The board is currently comprised of 1314 directors. Following the 2014 annual meeting, the board reduced the size of the board from 14 to 13, because John K. Lawson, a former director, exceeded our age eligibility requirement (a person who has reached the age of 72 is not eligible for election to the board), and could not be re-nominated for election at that meeting as a Class III director. As a result, his directorship ended at the 2014 annual meeting. Directors Baird, Besong, Brownson, Corby, Kilmer, Neuman, M. Peterson, R. Peterson, Ralph, Sorensen Ziegler and nominee BesongZiegler are deemed to be “independent” according to the NASDAQ listing requirements, and the board has determined that the independent directors do not have other relationships with us that prevent them from making objective, independent decisions. Directors Gipple, Helling, and Hultquist are not considered to be “independent” because they also serve as executive officers of either QCR Holdings or one of our subsidiaries. During 2014,2015, the board of directors had an Audit Committee, a Risk Oversight Committee, a Nomination and Governance Committee, a Compensation Committee a Strategic Direction Committee and an Executive Committee. The current charters of these committees (with the exception of the Strategic Direction Committee, which was dissolved in January 2015) are available on our website at www.qcrh.com. Also posted on the website is general information regarding QCR Holdings and our common stock, many of our corporate polices (including our Corporate Governance Guidelines), and links to our filings with the Securities and Exchange Commission. In 2014,2015, a total of fiveseven regularly scheduled meetings and two special meetings were held by the board of directors of QCR Holdings. All incumbent directors attended at least 75 percent of the meetings of the board and the committees on which they served during 2014.2015. Although we do not have a formal policy regarding director attendance at the annual meeting, we encourage our directors to attend. Last year, all but one of our directors were present at the annual meeting. Committees of the Board of Directors The composition of the board committees in 20142015 is shown in the following table:

Audit Committee . In 2014,.In 2015, the Audit Committee consisted of directors Brownson, Corby, Lawson (until his retirement in May),Kilmer, R. Peterson, Ralph and Ziegler. Each of the members is considered “independent” according to the NASDAQ listing requirements and the regulations of the Securities and Exchange Commission. The board of directors has determined that Ms. Ziegler qualifies as an “Audit Committee Financial Expert” as that term is defined by the regulations of the Securities and Exchange Commission. The board based this decision on Ms. Ziegler’s educational and professional experience, including her service as Vice President and Treasurer of Deere & Company.The functions performed by the Audit Committee include, but are not limited to, the following: | · | selecting ourselectingour independent auditors and pre-approving all engagements and fee arrangements;

|

| · | reviewing the independence of the independent auditors; |

| · | reviewing actions by management on recommendations of the independent auditors and internal auditors; |

| · | meeting with management, the internal auditors and the independent auditors to review the effectiveness of our system of internal control and internal audit procedures; |

| · | reviewing our earnings releases and reports filed with the Securities and Exchange Commission; and |

| | | | | · | reviewing reports of bank regulatory agencies and monitoring management’s compliance with recommendations contained in those reports. |

To promote independence of the audit function, the Audit Committee consults separately and jointly with the independent auditors, the internal auditors and management. The Audit Committee has adopted a written charter, which sets forth the committee’s duties and responsibilities. The current charter of the Audit Committee is available on our website at www.qcrh.com. Mr. Lawson previously servedhttp://www.snl.com/IRW/govdocs/1024092. Ms. Ziegler serves as Chair of the committee,and Ms. Corby serves as Vice Chair, which met four times in 2014, until his retirement in May. Ms. Ziegler currently serves as Chair. during 2015.Compensation Committee. In 2014,2015, the Compensation Committee consisted of directors Baird, Brownson, Kilmer, Neuman, R. Peterson, and Whitcher.Ralph. Each of these directors is considered to be “independent” according to the NASDAQ listing requirements, “outside” as defined in Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and a “non-employee” as defined in Section 16 of the Exchange Act. The purpose of the committeeCompensation Committee is to determine the salary and bonuscompensation to be paid to Mr. Hultquist, our Chief Executive Officer, and our other executive officers. The committeeCompensation Committee reviews Mr. Hultquist’s performance, and relies on Mr. Hultquist’s assessment of the performance of each of our other executive officers. Other members of senior management also provide the committeeit with evaluations as to employee performance, guidance on establishing performance targets and objectives, and recommendations with respect to other compensation programs. The committeeCompensation Committee also reviews and recommends to the board for approval other incentive compensation and equity compensation plans for QCR Holdings. The committee’s responsibilities and functions are further described in its charter, which is available on our website at www.qcrh.com. In 2014, Mr. Whitcher servedhttp://www.snl.com/IRW/govdocs/1024092. Ms. Neuman serves as Chair of the committee,and Mr. Kilmer serves as Vice Chair, which met foursix times during the year. Ms. Neuman currently serves as Chair. 2015.Nomination and Governance Committee. In 2014,2015, the Nomination and Governance Committee consisted of directors Brownson, Neuman, M. Peterson, R. Peterson, Sorensen, and Ziegler. Each of these directors is considered to be “independent” according to the NASDAQ listing requirements. The primary purposes of the committeeNomination and Governance Committee are to identify and recommend individuals to be presented to our stockholders for election or re-election to the board of directors and to review and monitor our policies, procedures and structure as they relate to corporate governance. We have adopted Corporate Governance Guidelines to assist our board in the exercise of its responsibilities, which are available on our website at www.qcrh.com.http://www.snl.com/IRW/govdocs/1024092. Additionally, the committee’s responsibilities and functions are further described in its charter, which is available on our website at www.qcrh.com.http://www.snl.com/IRW/govdocs/1024092. Mr. Brownson serves as Chair of the committee,and Ms. Sorensen serves as Vice Chair, which met four times during 2014. 2015.Risk Oversight Committee. In 2014,2015, the Risk Oversight Committee consisted of directors Besong, Brownson, Corby, Gipple, Helling, Hultquist, Kilmer, Ralph, Sorensen Ziegler and Whitcher.Ziegler. The Risk Oversight Committee is charged with being the primary board committee to actively monitor and oversee the risk management process. Additional information regarding risk oversight and the committee’sRisk Oversight Committee’s role is found on page 1918 of this proxy statement. The committee’s responsibilities and functions are further described in its charter, which is available on our website at www.qcrh.com.http://www.snl.com/IRW/govdocs/1024092. Ms. Corby serves as Chair of the committee,and Ms. Ziegler serves as Vice Chair, which met four times during 2014.2015. Strategic Direction Committee. In 2014, the Strategic Direction Committee consisted of directors Baird, Brownson, Corby, Gipple, Helling, Hultquist, Kilmer, Lawson (until his retirement in May), M. Peterson, Sorensen and Whitcher. John H. Harris, director of Quad City Bank and Trust, serves in an advisory capacity for the committee. The Strategic Direction Committee reviews policies and oversees and directs the strategic planning process, including QCR Holdings’s Information Technology strategy. Mr. Baird serves as Chair of the committee, which met twice during 2014. In December 2014, it was determined that the Strategic Direction Committee would dissolve effective January 2015, and the strategic planning process would be handled by the full board.

Executive Committee. In 2014,2015, the Executive Committee consisted of directors Baird, Brownson, Corby, Hultquist, Lawson (until his retirement in May), Whitcher,Neuman and Ziegler. The Executive Committeeis authorized to act with the same authority as the board of directors between meetings of the board, subject to certain limitations set forth in the committee’sits charter. Although this authority allows the board to act quickly on matters requiring urgency when the full board is not available to meet, it is not intended to supplant the authority of the full board. The committee’s responsibilities and functions are further described in its charter, which is available on our website at www.qcrh.com.http://www.snl.com/IRW/govdocs/1024092. Mr. Brownson serves as Chair of the committee,and Mr. Baird serves as Vice Chair, which met three times during 2014.once in 2015.Consideration of Director Candidates Director Nominations and Qualifications. For the 20152016 annual meeting, the Nomination and Governance Committee nominated for re-election to the board all of the incumbent directors, whose terms are set to expire in 2015, as well as John-Paul Besong, a new candidate for election to the board.2015. These nominations were further approved by the full board. We did not receive any stockholder nominations for director for the 20152016 annual meeting. Mr. Besong was generally identified by directors and management, including non-management directors and the Chief Executive Officer of QCR Holdings, as a candidate for nomination to the board of directors for his service and leadership in information technology at Rockwell Collins, a Fortune 500 company based in Cedar Rapids, Iowa, and his many contributions to the Cedar Rapids community.In carrying out its nominating function, the Nomination and Governance Committee has developed qualification criteria for initial board membership, and all potential nominees for election, including incumbent directors, board nominees and those stockholder nominees included in the proxy statement, are reviewed for the following attributes: | · | integrity and high ethical standards in the nominee’s professional life; |

| · | sufficient educational and professional experience, business experience or comparable service on other boards of directors to qualify the nominee for service to the specific board for which he or she is being considered; |

| · | evidence of leadership and sound judgment in the nominee’s professional life; |

| · | whether the nominee is well recognized in the community and has a demonstrated record of service to the community; |

| · | a willingness to abide by any published code of ethics for QCR Holdings; and |

| · | a willingness and ability to devote sufficient time to carrying out the duties and responsibilities required of a board member. |

The committeeNomination and Governance Committee also evaluates potential nominees to determine if they have any conflicts of interest that may interfere with their ability to serve as effective board members, to determine if they meet QCR Holdings’s age eligibility requirements (a person who has reached age 72 before the date of the annual meeting is not eligible for election to the board) and to determine whether they are “independent” in accordance with the NASDAQ listing requirements (to ensure that at least a majority of the directors will, at all times, be independent). While we do not have a separate diversity policy, the committeeNomination and Governance Committee does consider the diversity of its directors and nominees in terms of knowledge, experience, skills, expertise, and other demographics which may contribute to the board. The committeeIt has not, in the past, retained any third party to assist it in identifying candidates, but it has the authority to retain a third party firm or professional for the purpose of identifying candidates. The committeeNomination and Governance Committee identifies nominees by first evaluating the current members of the board willing to continue in service whose term is set to expire at the upcoming annual stockholder meeting to determine if those individuals satisfy the qualification criteria for continued membership on the board of directors. Prior to nominating an existing director for re-election to the board, the committeeit considers and reviews the following attributes with respect to each existing director: | · | board and committee attendance and performance; |

| · | length of board service; |

| · | experience, skills and contributions that the existing director brings to the board; |

| · | independence and any conflicts of interest; and |

| · | any significant change in the existing director’s status, including the attributes considered for initial board membership. |